Define Multifamily Ownership. As I mentioned in last week’s Client Focus article, there are many benefits to multifamily ownership in residential real estate. To kick off this conversation, I would like to first explain what exactly constitutes multifamily real estate . Basically, any piece of land or parcel that has more than one legal dwelling unit is classified as multifamily. This could be a duplex with shared side walls, a duplex that has one unit stacked on top of the other, a 2-on-1 with two separate structures on the same lot, or any combination of these attributes. Real estate law considers a multifamily property with 4 or more units to be commercial. This means the property is subject to different lender underwriting standards. Now that you understand what multifamily real estate is, let’s explore the main benefits.

BENEFIT #1 – CHEAPER PRICE PER UNIT THAN SINGLE FAMILY

Generally speaking, if you were to buy a multifamily residential property and divide the purchase price by the number of units (to get the price per unit/home), the amount would likely be much cheaper than purchasing a condominium or single family home with similar attributes. This means that you are essentially getting equivalent utility and rental income as you would in a condo or single family home for a much lower price. To bring these benefits to life, I want to use an example that I found in coastal Encinitas.

SINGLE FAMILY HOME: 721 3rd Street, Encinitas, CA – Sold $1.3M

MULTIFAMILY OWNERSHIP: 710 & 712 3rd Street, Encinitas, CA – For Sale $1.5M

Although the single-family home is slightly larger than each of the units in the multifamily residence, the price per unit on the duplex is $550,000 cheaper. This approximately equates to a 42% discount on the multifamily units as compared to the single family home. Given that the single family home is slightly larger in square footage and has an exclusive use yard, a premium would be warranted, but nowhere near the 42% calculated above.

BENEFIT #2 – LOWER OUT OF POCKET WITH HIGHER EQUITY ACCUMULATION

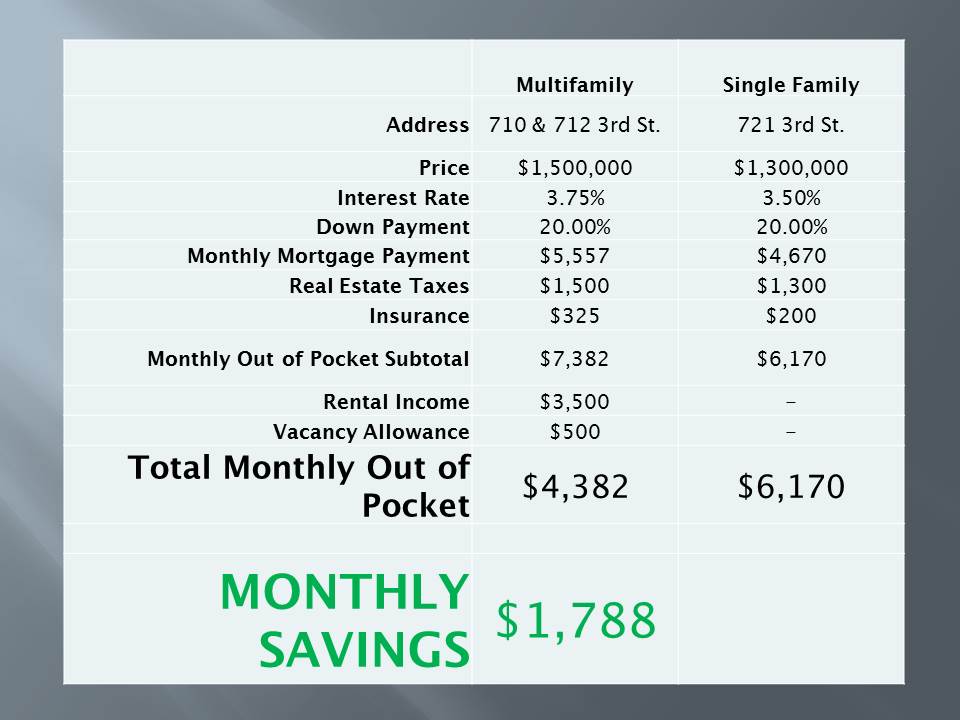

As you can see from the Encinitas example above, the multifamily property at 710 & 712 3rd Street is being offered for sale for $200,000 more than the single family alternative. Commonsense tells us that we would end up with more equity through multifamily ownership. It is worth more than the single-family home today and likely will be worth more in the future. Owning the more valuable property can lead to higher equity accumulation. However, the hidden benefit is that this higher equity accumulation can be achieved by SPENDING LESS MONEY out of pocket. Sound too good to be true? It’s not! Check out the below example using the Encinitas properties:

As you can see, your monthly out of pocket is $1,788 lower for the multifamily property in Encinitas. Thus, you pay less every month to acquire more equity and ultimately own a more valuable asset. All of this is without tax considerations which will typically further sweeten the deal!

BENEFIT #3 – LOWER INTEREST RATES AND DOWN PAYMENTS THAN PURELY INVESTMENT PROPERTY

Another significant benefit of purchasing a multifamily residence that you plan to live in is that you are able to essentially acquire an investment property at a discounted interest rate with a low down payment. Most investment property purchases require a minimum down payment of 25%. Also, an interest rate that is typically fifty basis points higher (4% vs. 3.5%) than a non-investment property. Depending on the lender and program, an owner-occupied multifamily property purchase in San Diego County can require as little as 3.5% down payment.

Our brokerage specializes in helping clients purchase multifamily properties. We have sophisticated experience dealing with both residential and commercial investment properties. Get in touch with us today to explore some options in your area!

Greg Robertson is a Broker at Class Realty Group’s San Diego office. Reach him by email at grobertson@classrealtygroup.com or by phone at 858-333-2422.